Introduction (Unlocking the Future of Banking: How to Use UPI ATM for Cardless Cash Withdrawal)

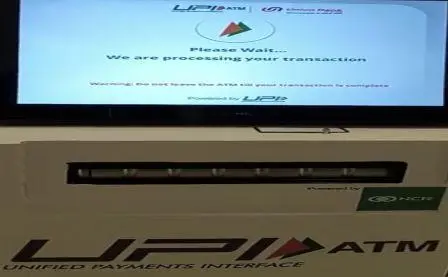

UPI ATM – In today’s fast-paced world of digital banking, convenience reigns supreme. With the introduction of UPI ATMs, a groundbreaking innovation by Hitachi Payment Services, accessing your hard-earned cash has never been easier. This comprehensive guide will walk you through the ins and outs of UPI ATMs, offering a seamless and secure method for cash withdrawal, all without the need for physical cards.

UPI ATM: The Future of Banking

The emergence of UPI ATMs represents a significant leap forward in the realm of banking services. These non-banking entities, in partnership with the National Payments Corporation of India (NPCI), stand ready to redefine the way we conduct financial transactions through these White Label ATMs.

The Evolution of ATMs:

Traditional ATMs have long been the cornerstone of banking convenience. However, UPI ATMs are set to transform the landscape. They combine the familiarity of ATMs with the power of UPI, offering customers a truly modern banking experience.

How to Use UPI ATM:

Do you find yourself intrigued by the intricate mechanisms of this state-of-the-art technology? The process is straightforward and user-friendly. Follow these step-by-step instructions to make the most of the Hitachi Money Spot UPI ATM:

Select Your Withdrawal Amount

Start by selecting the desired withdrawal amount from the ATM. This simple choice sets the stage for a hassle-free transaction.

(When you approach the UPI ATM, you’ll be presented with a range of withdrawal options. Whether it’s a small amount for everyday expenses or a larger sum for a special purchase, the choice is yours. This flexibility ensures that your banking experience is tailored to your specific needs.)

QR Code Display

Once you’ve made your selection, the ATM screen will display a QR code representing the chosen amount. This QR code is your virtual gateway to cash.

(The QR code is a crucial element in the UPI ATM transaction process. It contains essential information about your withdrawal, ensuring a seamless and error-free experience. Think of it as your digital key to accessing your funds.)

Also read – Living in Deeds, Not Years: A Guiding Proverb for a Meaningful Life

Scan with UPI App

Take out your mobile phone and open any UPI app you have installed. Carefully scan the QR code displayed on the ATM screen.

(Scanning the QR code is a breeze with UPI apps. It’s a quick and efficient way to establish a connection between your mobile device and the ATM. The seamless integration of these technologies ensures a smooth user experience.)

Enter Your UPI PIN

To authorize the transaction, input your UPI PIN on your mobile device. This added level of security guarantees that your funds can only be accessed by you.

(Security is paramount in digital banking, and UPI ATMs take it seriously. Your UPI PIN serves as a personal safeguard, preventing unauthorized access to your account. It’s a simple yet effective way to protect your finances.)

Cash Disbursement

Once your transaction is successfully authorized, the UPI ATM will promptly dispense the requested cash. It’s a quick and efficient process that ensures your banking needs are met with ease.

(The beauty of UPI ATMs lies in their speed and efficiency. Unlike traditional ATMs that require you to insert a physical card and enter a PIN, UPI ATMs simplify the process. With a few taps on your mobile device, cash is ready for you within moments.)

UPI ATM vs. Cardless Cash Withdrawal

You might be wondering how UPI ATMs distinguish themselves from existing cardless cash withdrawal methods.

Cardless cash withdrawals commonly depend on the use of mobile devices and the utilization of one-time passwords (OTPs). In contrast, the UPI ATM leverages QR-based UPI cash withdrawals.”

This distinction underscores the enhanced security and user-friendliness of UPI ATMs, making them a more advanced and convenient option.

(While cardless cash withdrawals have been a step forward in banking, UPI ATMs take it a notch higher. They eliminate the need for OTPs, streamlining the process with QR codes. This not only enhances security but also simplifies the user experience, making it accessible to a wider audience.)

Who Can Use UPI ATMs?

The beauty of UPI ATMs lies in their accessibility. Anyone with a registered UPI application on their Android or iOS device can harness the power of these ATMs. Whether you’re a tech-savvy individual or new to the world of digital banking, UPI ATMs are designed to cater to your needs.

The Inclusivity Factor

One of the significant advantages of UPI ATMs is their ability to bridge the gap in financial inclusion. These ATMs facilitate easy access to banking services in areas with limited traditional banking infrastructure and low card penetration. This means that more people, even in remote locations, can enjoy the benefits of convenient cash withdrawal.

Expanding on this: Financial inclusion is a critical goal for the banking industry, and UPI ATMs play a vital role in achieving it. They bring banking services to areas where traditional brick-and-mortar banks may be absent. This inclusive approach ensures that individuals in underserved regions can participate fully in the digital economy.

Future Prospects

The launch of the Hitachi Money Spot UPI ATM at the Global Fintech Fest 2023 in Mumbai is just the beginning. As these UPI ATMs expand to more locations across India, the days of carrying physical debit or credit cards to ATMs will become a thing of the past.

Seamless Integration of UPI

These UPI ATMs will seamlessly integrate the convenience and security of UPI into traditional ATMs. This innovative concept is designed to provide quick access to cash even in the most remote areas of India without the need for a physical card.

Expanding on this: The integration of UPI into ATMs is a step towards a cashless society. It not only reduces the reliance on physical cards but also aligns with the Indian government’s vision of a digital-first economy. With UPI ATMs, accessing cash will be as simple as using a smartphone, regardless of your location.

Enhancing Security

In an era where financial fraud is a concern, UPI ATMs offer a robust solution. One of their key advantages is the elimination of the risk of ‘skimming,’ a common method used by fraudsters to steal card information.

Enhanced Security Measures

UPI ATMs rely on QR codes and UPI PINs for transactions, making it significantly harder for fraudsters to gain unauthorized access to your funds. This added layer of security ensures peace of mind for users.

Expanding on this: Security is paramount in the world of banking. UPI ATMs address this concern with advanced security measures. The use of QR codes ensures that each transaction is uniquely identified, reducing the risk of data breaches. Moreover, the requirement of a UPI PIN adds an extra level of protection, making it a formidable deterrent against fraudulent activities.

Conclusion

In conclusion, the introduction of UPI ATMs is a monumental step forward in the realm of banking services. With a user-friendly approach, robust security measures, and accessibility for all, these ATMs are ready to redefine how we interact with our banks.

The Road Ahead

As UPI ATMs continue to roll out across the nation, we can anticipate a future where cash withdrawal is as simple as scanning a QR code on your mobile device. Embrace the future of banking with UPI ATMs – it’s a cardless revolution that’s here to stay, offering unparalleled convenience and security in the world of finance.

(The journey ahead is one of convenience, security, and financial inclusion. UPI ATMs are not just a technological marvel; they represent a shift in how we perceive banking. With every transaction, we inch closer to a cashless, digital future where access to funds is effortless and secure. The world of banking is evolving, and UPI ATMs are at the forefront of this transformative journey.)