Introduction:

In recent years, the Unified Payments Interface (UPI) has revolutionized the way Indians make digital payments. This groundbreaking system has introduced a remarkable feature called ‘UPI Now Pay Later,’ allowing users to complete UPI transactions even when their bank accounts lack sufficient funds. In this comprehensive guide, we will explore the intricacies of this innovative UPI feature, elucidating its mechanics, advantages, and the steps to leverage its benefits.

Understanding UPI Now Pay Later:

The Unified Payments Interface (UPI) stands as a real-time payment system in India, facilitating instantaneous transactions via smartphones. It has gained widespread acclaim for its user-friendliness, security, and broad acceptance among banks and businesses. UPI Now Pay Later adds another layer of versatility to this already dynamic platform.

How UPI Now Pay Later Functions:

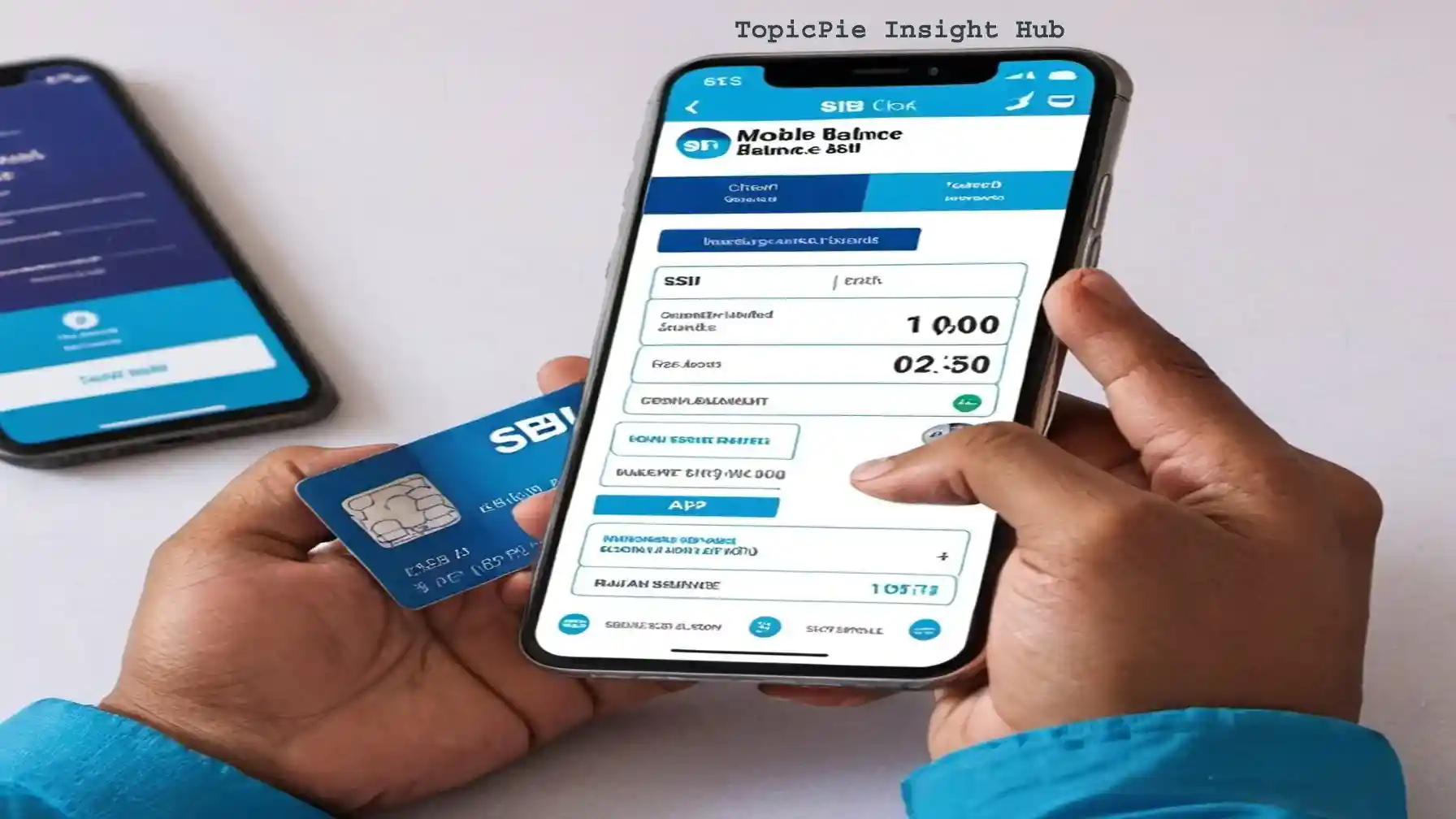

To employ UPI Now Pay Later, users must first secure approval from their banks for a credit line. This involves a credit evaluation, during which the bank assesses the user’s creditworthiness and determines an appropriate credit limit. Once sanctioned, the user’s UPI account becomes linked to this credit line.

Now, when a user intends to make a UPI payment but lacks the necessary balance in their account, they can effortlessly tap into the pre-approved credit limit. This means that even if your account balance is insufficient, you can proceed with the transaction, with the amount debited from your credit line.

Advantages of UPI Now Pay Later:

Enhanced Convenience: UPI Now Pay Later redefines convenience. It eradicates concerns about having adequate funds in your account when initiating UPI payments, particularly beneficial in urgent payment scenarios with low account balances.

- Interest-Free Grace Period: Among the most significant advantages of UPI Now Pay Later is the interest-free period it offers. Following a transaction, users are granted a specific timeframe within which they can settle the amount without incurring any interest or additional charges. This grace period empowers users to manage their finances adeptly.

Augmented Financial Flexibility: This feature elevates financial flexibility. It empowers users to make payments as needed, irrespective of their current financial situation. It serves as a valuable tool for cash flow management, ensuring essential payments are not delayed due to temporary financial constraints.

How to Utilize UPI Now Pay Later:

Leveraging UPI Now Pay Later is a straightforward process. Here is a step-by-step guide:

Approval: Begin by obtaining approval from your bank for a credit line. This necessitates the submission of financial information and a credit check. The bank will then establish your credit limit based on your creditworthiness.

Link Accounts: Ensure seamless linkage between your UPI account and the approved credit line. This connection guarantees access to the credit line when making UPI payments.

Payment Execution: While initiating a UPI payment, if your account balance falls short, you can opt for UPI Now Pay Later. By choosing this option, your transaction proceeds smoothly, and the amount is deducted from your credit line.

Repayment Period: After completing the payment, a specific timeframe for repayment will be provided. During this period, you can settle the amount spent without incurring additional charges. Adhering to this repayment schedule is crucial to maintaining the interest-free status of your transaction.

The Popularity of UPI in India:

The Unified Payments Interface has witnessed exponential growth in popularity within India. It has reshaped how people engage in financial transactions, making them more accessible and efficient than ever before. Several factors contribute to UPI’s widespread acceptance:

User-Friendly: UPI is exceptionally user-friendly, catering to individuals with varying levels of technological proficiency. Setting up a UPI ID can be as straightforward as linking it to your mobile number. Once configured, transactions can be initiated with just a few taps on your smartphone.

- Security Emphasis: UPI prioritizes security, employing robust encryption and authentication methods to safeguard your financial data and transactions. UPI PINs and two-factor authentication add layers of protection.

- Versatility: UPI is versatile and widely accepted. It serves various purposes, from bill payments and online purchases to money transfers, utility payments, and in-store transactions. This adaptability positions it as a comprehensive payment solution.

Availability Around the Clock: UPI operates 24/7, allowing transactions at any time, even beyond traditional banking hours. This flexibility is especially valuable for those requiring dynamic financial management.

Interoperability: UPI transcends individual banks or financial institutions. It operates as an interbank transfer system, enabling the use of UPI across various banks for seamless transactions.

Government Backing: The Indian government has proactively supported and promoted UPI as part of its digital payment initiatives. This endorsement has led to widespread adoption by businesses and service providers across the nation.

Promoting a Cashless Society: UPI has played a pivotal role in India’s journey towards a cashless society. It reduces reliance on physical currency, encourages digital transactions, and promotes financial inclusion and transparency.

The Evolution of UPI: A Game Changer:

UPI Now Pay Later is not just an isolated feature; it’s part of the broader evolution of UPI. Over the years, UPI has continued to adapt and expand its capabilities to meet the changing needs of users and businesses. Here are some key milestones in the evolution of UPI:

Introduction of QR Code Payments: QR code payments have become ubiquitous in India, thanks to UPI. Businesses, big and small, have adopted QR codes for accepting payments. Users can simply scan a QR code to initiate a transaction, making it a convenient and contactless payment method.

- Bill Payments and Recharges: UPI has made it effortless to pay bills and recharge mobile phones and DTH services. Users can easily settle utility bills, book tickets, and even pay school fees using UPI apps.

UPI 2.0-Enhanced Features: UPI 2.0 introduced several enhancements, including the ability to link multiple bank accounts to a single UPI ID, overdraft facility, and the option to set up one-time mandates for recurring payments.

Integration with Third-Party Apps: UPI has integrated seamlessly with various third-party apps, enabling users to shop online, order food, and book rides with ease. It has become the preferred payment method for many online platforms.

Biometric Authentication: Some UPI apps now offer biometric authentication, such as fingerprint and facial recognition, adding an extra layer of security and convenience.

International Expansion: UPI is not limited to domestic transactions. It has expanded its reach to international markets, allowing users to send money abroad through authorized channels.

Emphasis on Financial Literacy: UPI providers have taken steps to promote financial literacy and responsible usage. Users are encouraged to understand interest rates, repayment terms, and financial planning when utilizing features like UPI Now Pay Later.

Conclusion: UPI Now Pay Later and India’s Digital Future:

In conclusion, UPI Now Pay Later represents a revolutionary enhancement to the Unified Payments Interface, further elevating the convenience and flexibility it offers to users. With this feature, individuals can execute payments even when their account balances are insufficient, with the option to repay the amount at a later date without incurring additional costs. UPI continues to evolve, establishing new benchmarks for digital payments in India and beyond.

Embrace the convenience, accessibility, and financial empowerment offered by UPI Now Pay Later, and be part of India’s exciting digital future. The journey toward a cashless, digitally empowered India is ongoing, and UPI, with features like UPI Now Pay Later, is leading the way. It’s not just a payment method; it’s a catalyst for financial inclusion and innovation in the world of digital transactions. As UPI continues to evolve, it will shape the future of payments and redefine how we manage our finances.

Also Read: SBI Pension Loan: Your Financial Solution in Retirement

EXCELLENT features of the Application

EXCELLENT features