Introduction: Pioneering Secure and Accessible Banking with IRIS Scanner

In the fast-paced world of banking technology, the IRIS Scanner or Iris Recognition System emerges as a game-changer, transforming the way users interact with their financial institutions. From secure transactions to enhanced accessibility, this blog explores the multifaceted impact of IRIS Scanner technology on modern banking.

In the landscape of modern banking, the introduction of Iris Recognition System technology at SBI Kiosk Outlets signifies a groundbreaking shift. This cutting-edge biometric authentication tool ensures secure transactions and overcomes the limitations of traditional fingerprint scanners.

Unlocking Security: The Essence of Iris Recognition System

The Iris Recognition System, utilizing unique iris patterns, offers a robust layer of security. Unlike fingerprints that may change over time, the iris remains a stable and distinctive identifier. This not only enhances the security of transactions but also addresses inconveniences faced by users with fingerprint authentication.

Convenience Redefined: Iris Recognition System and AEPS Transactions

- IRIS Scanner at SBI Kiosk Outlets: A New Era of Convenience

The successful rollout of AEPS transactions through IRIS Scanner at SBI Kiosk Outlets is a testament to enhanced convenience. Users now have an additional option for secure transactions, especially crucial in areas where traditional ATMs are not readily available.

- Diversifying Transactions: Beyond Withdrawals with Iris Recognition System

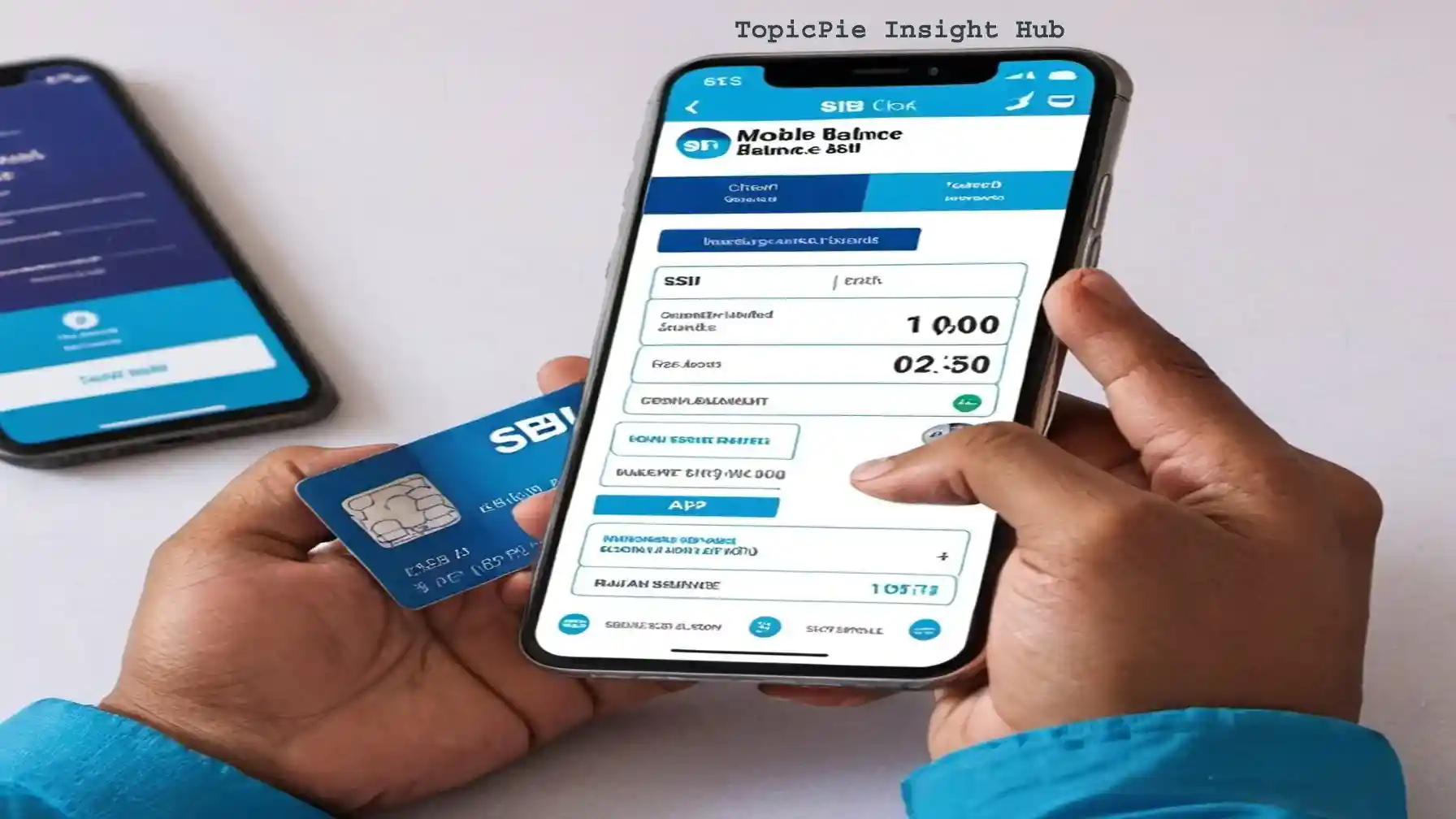

Presently, transactions through Iris Recognition System focus on withdrawals. However, the future holds the promise of a more comprehensive range of transactions, including fund transfers, cash deposits, balance inquiries, and mini statements. This evolution underscores the adaptability and potential of IRIS Scanner technology.

Navigating AEPS Transactions with IRIS Scanner: A User Guide

- Aadhaar Seeding: The Key to IRIS Scanner Transactions

To leverage AEPS transactions through the Iris Recognition System, users must ensure their Aadhaar numbers are securely seeded to their bank accounts. Those yet to complete Aadhaar seeding can visit their respective branches with the necessary KYC documents.

- Visit an SBI Kiosk Outlet: Gateway to Modern Banking

SBI Kiosk Outlets, equipped with Iris Recognition System, democratize access to modern banking. From urban centers to remote rural areas, these outlets empower users to experience the convenience of IRIS Scanner transactions.

- Aadhaar Number Input: Initiating the IRIS Scanner Transaction

Inputting the Aadhaar number at the Kiosk Outlet initiates the IRIS Scanner authentication process. The user’s identity is seamlessly authenticated through the Iris Recognition System, setting the stage for a secure and efficient transaction.

- Selecting Transaction Type: IRIS Scanner Customization

Authenticated users can choose their desired transaction type. While currently focusing on withdrawals, the future of Iris Recognition System capabilities holds the promise of diverse transactions, providing users with unparalleled flexibility.

Impact of Iris Recognition System on Financial Inclusion: Bridging the Gap

The rollout of IRIS Scanner transactions extends beyond technological innovation; it is a stride towards financial inclusion. SBI Kiosk Outlets strategically placed in both urban and rural areas pave the way for a more inclusive banking experience.

Optimizing the IRIS Scanner Experience: Recommendations

- Widespread Outlet Expansion: Banking at Every Doorstep

SBI’s commitment to increasing Kiosk Outlets, especially in underserved regions, ensures that the benefits of IRIS Scanner transactions reach a broader demographic. A wider network of outlets translates to increased accessibility for users.

- Transaction Cost Reduction: Democratizing Transactions through Iris Recognition System

To foster broader adoption, reducing transaction charges associated with IRIS Scanner transactions is essential. This move aligns with the goal of making these services more financially accessible for a diverse user base.

- Educational Initiatives: Empowering Users with Knowledge of Iris Recognition System

Public awareness campaigns and educational initiatives play a pivotal role in bridging the gap between technology and users. Increased awareness ensures that the potential of IRIS Scanner technology is maximized.

Inclusivity and Security: IRIS Scanner as a Biometric Ally

Beyond its technical prowess, the IRIS Scanner emphasizes inclusivity. This technology becomes a game-changer for individuals with disabilities who may face challenges with traditional fingerprint scanners.

Preventing Fraud through IRIS Scanner: A Cybersecurity Shield

As cyber threats evolve, the Iris Recognition System emerges as a formidable ally against fraud. The complexity of forging iris biometrics makes unauthorized access significantly more challenging, enhancing the overall security of banking transactions.

Promoting Digital Payments: The Swift Transition

AEPS transactions through the Iris Recognition System contribute to the broader narrative of promoting digital payments. The efficiency and simplicity of these transactions encourage users to embrace digital payment modes, propelling society towards a cashless future.

Conclusion: Iris Recognition System – Shaping the Future of Banking

The successful rollout of AEPS transactions through the Iris Recognition System at SBI Kiosk Outlets marks a transformative chapter in the banking industry. This technology not only addresses existing challenges but also propels the sector into a new era of accessibility, security, and inclusivity.

Navigating the Banking Landscape with IRIS Scanner

- Enhanced User Experience: A Seamless Journey

The Iris Recognition System not only provides heightened security but also contributes to an overall enhanced user experience, making banking transactions more user-friendly.

Realizing the Vision of a Cashless Society: A Technological Odyssey

With the ease and efficiency of AEPS transactions through Iris Recognition System, there’s a tangible step towards realizing the vision of a cashless society, aligning with the broader digital transformation goals.

- Community Engagement: Connecting Communities with Technology

By strategically placing Kiosk Outlets, SBI ensures that the benefits of Iris Recognition System technology reach far and wide, fostering community engagement and technological empowerment.

- Continuous Innovation: Shaping the Future of Banking

The success story of Iris Recognition System is a testament to the importance of continuous innovation in the banking sector. Embracing technological advancements ensures that banks remain at the forefront of providing efficient and secure services to their customers.

By seamlessly integrating technology of Iris Recognition System into everyday banking transactions, the State Bank of India is not just embracing innovation; it’s shaping the future of banking for a diverse and interconnected society. As users continue to experience the advantages of this revolutionary technology, the ripple effects will extend beyond individual transactions, contributing to the evolution of the entire banking landscape.

Also Read:

Central Bank Digital Currency: The eRupee Revolution in India

The 2024 KTM 990 DUKE – भारत के युवा में परचलित 2024 KTM 990 DUKE कर सकती है, आगमन का ऐलान –

Terrific article! That is the kind of information that should

be shared around the net. Shame on Google for no longer

positioning this publish higher! Come on over and

seek advice from my web site . Thanks =)

Feel free to surf to my web page: vpn special code

Thankfulness to my father who stated to me about this web site, this weblog is actually

awesome.

Here is my blog post; vpn special coupon code 2024