Introduction:

Imagine a future where financial security is no longer a distant dream, but a tangible reality. Atal Pension Yojana envisions a future where every Indian retires with dignity. It aims to empower individuals through an affordable pension scheme, ensuring financial security. In this vision, citizens enjoy their golden years without financial worries. Atal Pension Yojana is the key, making a secure future accessible to all.

In this blog post, we’ll explore the features of Atal Pension Yojana. We’ll also understand eligibility criteria and delve into the subscription process. Additionally, we’ll shed light on how this scheme benefits Indian citizens. So, grab a cup of tea and join us on this enlightening journey towards financial stability!

History of Atal Pension Yojana:

The Atal Pension Yojana (APY) is a government-backed pension scheme in India that was launched on 9th May 2015. This initiative was introduced by the Ministry of Finance and aims to provide financial security to the elderly population, especially those working in the unorganized sector.

Before the introduction of APY, there were various other social security schemes targeted at different sections of society. However, there was no specific pension scheme for workers in the unorganized sector who are often neglected when it comes to retirement benefits.

To address this gap, APY was created. Its objective: to ensure a guaranteed minimum monthly pension for subscribers in old age. The scheme is named after former Prime Minister Atal Bihari Vajpayee, paying tribute to his commitment to improving the lives of ordinary citizens.

Since its launch, APY has witnessed significant growth in terms of enrollment numbers. It has gained popularity due to its simplicity and affordability. With contributions starting as low as Rs. 42 per month, individuals can now secure their future post-retirement.

Through its history and evolution over time, Atal Pension Yojana has become an essential tool for providing financial stability and support to millions of Indian citizens working in the unorganized sector.

Scheme Details:

The Government of India launched the Atal Pension Yojana (APY) on 9th May 2015, aiming to provide financial security for unorganized sector workers.

Under this scheme, subscribers are required to contribute a fixed amount every month from the age of 18 till they reach 60 years. The monthly contribution depends on the chosen pension amount and age of entry into the scheme.

The APY offers five different pension options ranging from Rs. 1,000 to Rs. 5,000 per month, depending on eligibility criteria and contributions made over time.

To avail of the benefits of this scheme, individuals need to have a valid Aadhaar Seeded bank account.

In case subscribers wish to discontinue or exit the scheme before attaining the age of 60 years, they can do so but will receive only their own contributions along with interest earned on them.

It’s important for potential beneficiaries to understand that joining Atal Pension Yojana requires regular contributions towards building up a retirement corpus for ensuring financial independence during old age.

Features of Atal Pension Yojana:

The Atal Pension Yojana (APY) is a government-backed pension scheme that aims to provide financial security to the citizens of India during their old age. This scheme comes with several features that make it an attractive option for individuals looking to secure their future.

One key feature of APY is its affordability. The contribution amount under this scheme is based on the age and desired pension amount, making it accessible for people from all income groups. Moreover, the government provides co-contribution for eligible subscribers, further reducing the burden on individuals.

Another notable feature is the fixed pension amount provided by APY. Depending on the contribution made and years of service, a predetermined monthly pension is assured after retirement. This ensures a steady stream of income post-retirement and helps individuals maintain their standard of living.

Furthermore, APY offers flexibility in terms of withdrawal options. Subscribers can choose to receive their accumulated corpus as either a lump sum or as a monthly pension, depending on their preference and financial requirements.

Additionally, APY provides benefits such as portability across jobs and locations within India. This means that if an individual changes jobs or moves cities, they can seamlessly continue contributing towards their pension without any hassle.

One significant feature worth highlighting about APY is its tax benefits. Contributions made towards this scheme are eligible for tax deductions under Section 80CCD(1B) of the Income Tax Act up to Rs 50,000 annually.

These features make Atal Pension Yojana an attractive choice for Indian citizens who want to ensure financial stability in their golden years. With affordability, fixed pensions amount along with flexible withdrawal options and tax benefits; APY offers comprehensive coverage when it comes to securing one’s retirement years.

Eligibility for Atal Pension Yojana:

To avail the benefits of Atal Pension Yojana, individuals must meet certain eligibility criteria. Let’s take a look at who can enroll in this scheme.

The age limit plays a crucial role. Any Indian citizen between the ages of 18 and 40 years can apply for the Atal Pension Yojana. This means that both young professionals and those nearing their retirement years can participate in this scheme.

It is mandatory to have a valid Aadhaar card linked with your bank account. The government has made this requirement to ensure transparency and efficient fund disbursal.

One should not be an existing member of any other statutory social security scheme like EPF or NPS. Enrolling in multiple schemes simultaneously may lead to complications in terms of contribution and benefits received.

It’s essential to note that eligibility for Atal Pension Yojana requires active bank accounts. This ensures smooth fund transfers through the designated National Payments Corporation of India (NPCI) platform directly into the beneficiaries’ accounts.

By meeting eligibility criteria, individuals can enroll in Atal Pension Yojana. Enjoy its features hassle-free for a secure financial future!

Subscription Process:

Enrolling in the Atal Pension Yojana (APY) is a straightforward and convenient process, designed to be accessible to all Indian citizens. To participate in the scheme, individuals can visit authorized banks, post offices, or Customer Service Points (CSP) allocated by respective banks and operated by Kiosk Operators. At these locations, applicants can easily fill out a registration form, providing essential details along with their Aadhaar card number. This inclusive enrollment approach ensures that the APY Scheme is readily available to a wide range of individuals seeking to secure their financial future.

Once the application is submitted, the bank or post office will verify the information provided and open an APY account for the individual. The subscriber will receive a unique Permanent Retirement Account Number (PRAN), which is essential for future transactions related to APY.

After opening an account, subscribers have the flexibility to choose their desired pension amount based on their age and contribution capacity. The monthly contribution can be made either through auto-debit from a savings bank account or by providing post-dated cheques.

It’s important to note that individuals must ensure sufficient funds are available in their linked bank account on the scheduled date of contribution deduction. Not adhering to this may lead to the imposition of penalties.

Subscribing to Atal Pension Yojana is a straightforward process that empowers Indian citizens with a secure retirement plan. So why wait? Take advantage of this government-backed scheme today!

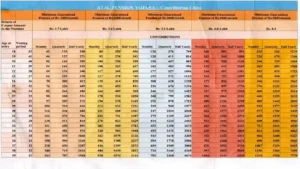

Contribution Chart for Atal Pension Yojana:

One of the key factors that make Atal Pension Yojana an attractive investment option for Indian citizens is its contribution chart. This chart outlines the monthly contributions required based on the desired pension amount and the age at which you start investing.

The contribution chart is designed to ensure affordability and flexibility for individuals from all income groups. It offers four different pension slabs – Rs. 1000, Rs. 2000, Rs. 3000, and Rs. 5000 per month – depending on your financial goals and requirements.

To give you a better idea, let’s take an example: If you are 30 years old and want to receive a monthly pension of Rs. 3000, then you need to contribute approximately Rs. 577 every month until you reach the age of retirement (60 years). However, if you decide to start investing at a later age, say 40 years old, then your monthly contribution would increase significantly.

It’s important to note that these contributions may vary based on your chosen auto-debit options. This can be from your bank account or through other modes like cash or cheque, leading to potential variations.

Referring to the contribution chart before enrolling in Atal Pension Yojana allows individuals to assess their financial capabilities. They can determine the appropriate amount to invest in securing their future retirement income. This proactive step ensures a well-informed decision-making process.

The contribution chart from Atal Pension Yojana aids in planning retirement. It offers clarity on monthly contributions based on factors like pension amount and starting age. This tool guides individuals toward achieving their financial goals efficiently.

Most Searched Information about Atal Pension Yojana:

In this article, we have explored the various features and benefits of Atal Pension Yojana, a government initiative aimed at providing financial security to Indian citizens during their retirement. This scheme has gained immense popularity due to its attractive features and ease of enrollment.

The Government of India launched Atal Pension Yojana in 2015, envisioning pension coverage for all individuals in the unorganized sector. Since then, millions of Indians have enrolled in this scheme and are reaping its numerous benefits.

Atal Pension Yojana offers a simple yet effective way for individuals to save for their post-retirement life. With flexible contribution options based on age and desired pension amount, anyone can start planning for their future without any hassle. The monthly contributions are affordable and tailored according to different income groups, making it accessible to everyone.

One of the key features that sets Atal Pension Yojana apart is its guaranteed minimum pension amount ranging from Rs. 1,000 to Rs. 5,000 per month depending on the contribution made by an individual over their working years. This ensures a steady stream of income even after retirement when regular earnings might cease.

Also Read: Day 11 Advance Booking Report for Animal Movie | Box Office Collection Update for Animal Movie on Day 11.

To be eligible for Atal Pension Yojana, one must fall within the age group of 18-40 years and should not be covered under any other statutory social security schemes such as Employees’ Provident Fund (EPF) or National Pension System (NPS). This widens the scope for inclusion and allows more people to benefit from this scheme.

Enrolling for Atal Pension Yojana is straightforward. Minimal documentation, such as Aadhaar card and bank details, is required. Interested individuals can visit nearby banks or utilize online platforms. Authorized institutions, including insurance companies, mutual funds, or Customer Service Points (CSP) allocated by banks and operated by Kiosk Operators, provide convenient subscription options.

The contribution chart for Atal Pension Yojana helps individuals understand how much they need to contribute based on their age and desired pension amount. It provides a clear roadmap for planning and ensuring a comfortable post-retirement life.

Atal Pension Yojana provides flexibility. Adjust pension amount and contribution frequency based on individual financial situations. Increase or decrease contributions, choose monthly, quarterly, or semi-annual payment modes for convenience.

To encourage more people to enroll in this scheme, the government has introduced attractive incentives such as co-contribution by the government of 50% of the subscriber’s contribution or Rs. 1,000 per annum (whichever is lower) for a period of 5 years for eligible individuals.

In case of unfortunate demise of the subscriber, Atal Pension Yojana offers a provision for the spouse to continue receiving the pension or receive a lump sum amount equivalent to the contributions made by the subscriber. This ensures that even after death, the family is financially secure.

Conclusion:

In conclusion, Atal Pension Yojana is a beacon of financial security, guiding millions towards a worry-free retirement. Its history, features, eligibility, and subscription process make it comprehensive. The contribution chart and relevant details ensure accessibility and transparency in planning for a secure future.

Atal Pension Yojana caters to the specific needs of the unorganized sector, bridging gaps in social security. This ensures every citizen has the opportunity to build a retirement corpus confidently. Its simplicity, affordability, and fixed pension amounts provide a reliable foundation for a secure post-retirement life.

As we navigate financial planning complexities, Atal Pension Yojana emerges as a reliable companion. It offers not just a pension scheme but a promise of financial dignity and independence in the golden years. Let’s take a proactive step towards securing our future and embracing the assurance that Atal Pension Yojana brings to the table. After all, a financially stable retirement is not just a dream; it’s a tangible reality within our grasp.

Also Read: A Spiritual Journey to Parshuram Kund: Arunachal Pradesh’s Sacred Pilgrimage Site

Exploring the Atal Pension Yojana features is an eye-opener! This scheme truly empowers Indian citizens by offering a secure financial future. The benefits it provides, ensuring financial stability during retirement, are a game-changer. Kudos to the government for this initiative! 🙌💰 #AtalPensionYojana #FinancialEmpowerment