Introduction:

In today’s fast-paced digital age, where technology rules the roost, constant updates and upgrades are essential to keep up with the ever-evolving technological landscape. We owe this relentless pursuit of excellence to our dedicated team of technical experts and computer engineers who ensure that we can enjoy the benefits of internet services in our daily lives. Internet services have become integral to the banking sector, fueling the growth of digital transactions. However, as we embrace the convenience of digital banking, security remains a paramount concern. To address these challenges, the State Bank of India (SBI) is continuously updating and upgrading its Kiosk Portal, working tirelessly to provide top-notch service to customers at their nearest Customer Service Points (CSPs) across the country.

In this article, we will explore the recent developments in the SBI Kiosk Portal, designed to enhance the banking experience for customers visiting various CSPs for their transactions. These updates reflect the bank’s commitment to convenience and security in the digital banking era. We will delve into two new features/services that have been added to the SBI Kiosk Portal, making banking transactions smoother and more accessible for customers.

SBI Kiosk Portal – A Beacon of Technological Progress:

The SBI Kiosk Portal has been a pioneer in leveraging technology to offer convenient banking services to the masses. With the rise of digital transactions, the need for robust and secure systems has become more evident than ever. The technical team at SBI has been relentless in their efforts to ensure the portal’s functionality remains up to date, safeguarding the interests of millions of customers.

In the ever-evolving world of technology, staying ahead is not just an aspiration but a necessity. The SBI Kiosk Portal exemplifies this commitment by undergoing continuous updates and upgrades. These initiatives are undertaken to keep the portal robust, secure, and aligned with the evolving needs of the modern banking customer.

Continuous Updation and Upgradation of Server of SBI Kiosk Portal:

As digital transactions continue to gain traction, security concerns take center stage. The dedicated technical team at SBI is working tirelessly to update and upgrade the servers, enhancing the security features of digital transactions. This relentless pursuit of excellence is pivotal in ensuring the safety and integrity of financial transactions conducted through the SBI Kiosk Portal.

The process of updating and upgrading the server is a complex task that involves a series of steps. First and foremost, the team monitors emerging threats and vulnerabilities in the digital landscape. They assess the existing server infrastructure and identify areas that require improvement. This could include strengthening encryption protocols, enhancing authentication mechanisms, and bolstering intrusion detection systems.

Once the areas for improvement are identified, the team begins the process of server updation. This involves installing the latest security patches, updating the firewall rules, and implementing advanced security measures. The goal is to create a server environment that can withstand even the most sophisticated cyberattacks.

Recent Developments in SBI Kiosk Portal:

Let’s dive into the recent enhancements made to the SBI Kiosk Portal, aimed at providing customers with a seamless and secure banking experience.

1) Generation of Mini Statement of Aadhaar Seeded Account in SBI Kiosk Portal

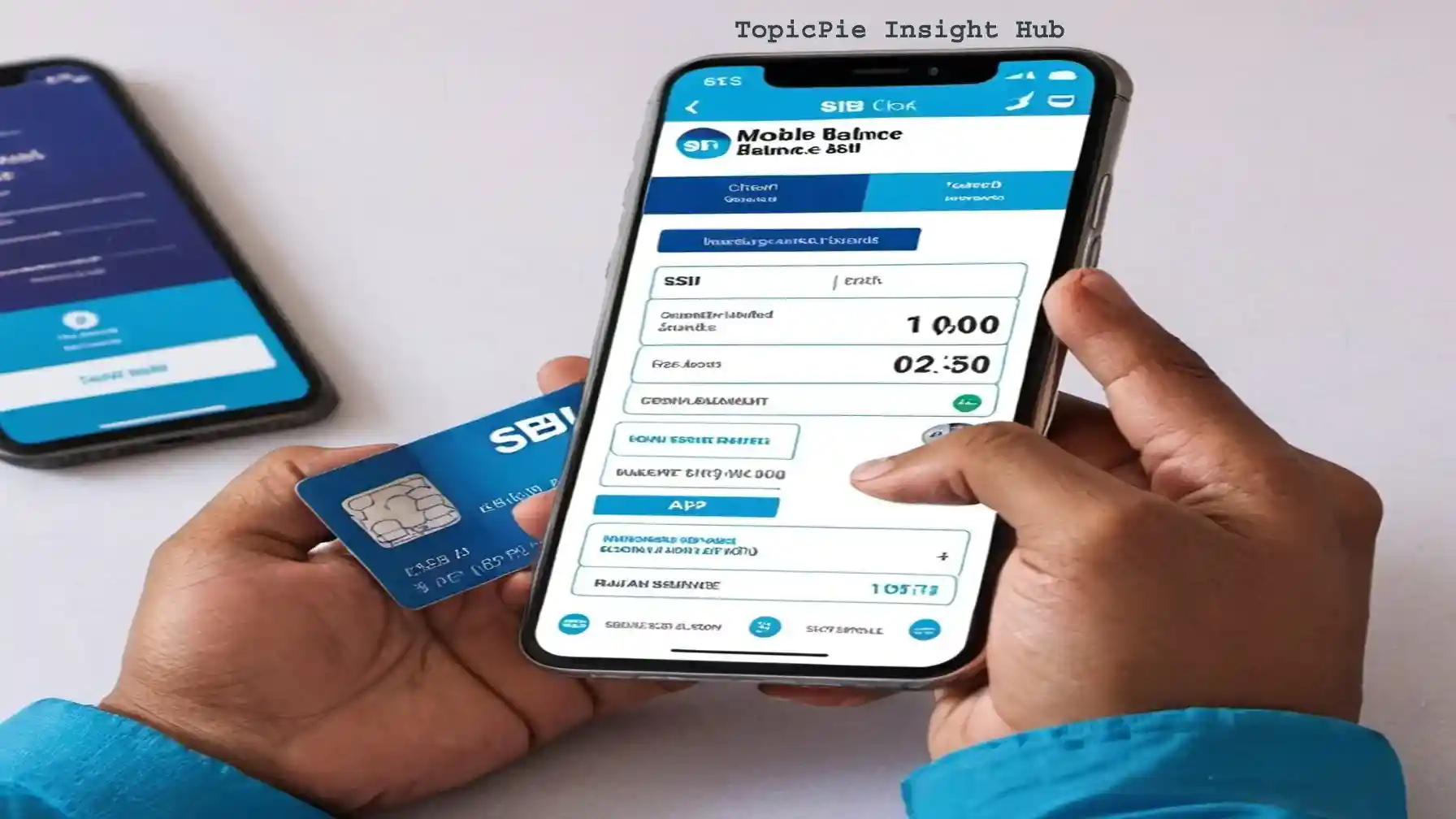

The SBI Kiosk Portal now offers users the ability to generate a mini statement for Aadhaar-seeded accounts. This feature is available for both SBI accounts (AEPS Onus Mini Statement) and non-SBI accounts (AEPS Offus Mini Statement). Any account holder whose account is linked to their Aadhaar number can visit their nearest CSP to access this service.

A mini statement provides a snapshot of the most recent transactions in an account. While it offers limited transaction history, it is a valuable tool for customers to stay informed about their account activity. Previously, customers could only check their account balance and withdraw cash, with limits in place. Now, the addition of mini statements enhances the range of services available at CSPs.

The introduction of mini statements addresses a common need among bank customers – the ability to quickly access recent transaction information. Whether it’s confirming a salary deposit, verifying a payment, or tracking expenses, a mini statement provides an instant snapshot of account activity. This allows customers to make well-informed financial decisions while on the move.

2) OTP Based Cash Deposit in any SBI Account:

Another significant enhancement in the SBI Kiosk Portal is the introduction of OTP-based cash deposit. This feature has been seamlessly integrated into the portal, making it mandatory for customers to bring their mobile handsets with active SIM cards when depositing cash into their SBI accounts through CSPs.

The process is straightforward: when a customer initiates a cash deposit transaction at a CSP, an OTP (One Time Password) is sent to their mobile device. The customer shares this OTP with the Kiosk Operator, completing the cash deposit transaction successfully. It’s important to note that the mobile number used during the transaction does not need to be the same as the one registered with the bank account.

The Significance of These Updates:

The introduction of these two features reflects SBI’s commitment to making banking more accessible and secure for its customers. Let’s delve deeper into the benefits of these updates.

Enhanced Convenience:

The ability to generate a mini statement at CSPs is a boon for customers who want to quickly check their recent transactions. Whether it’s monitoring salary deposits, tracking expenses, or verifying payments, this feature empowers customers with real-time information.

In today’s fast-paced world, access to real-time financial information is invaluable. Customers no longer have to wait for monthly statements or visit a branch to obtain transaction details. The convenience of generating a mini statement at a nearby CSP makes managing finances a breeze.

Improved Security:

The OTP-based cash deposit adds an extra layer of security to transactions. With OTP verification, the risk of unauthorized deposits is significantly reduced, protecting customers from potential fraud.

Financial security is a top priority for both customers and banks. The introduction of OTP-based cash deposit aligns with SBI’s commitment to safeguarding its customers’ interests. This feature not only deters fraudulent transactions but also enhances customer confidence in digital banking.

Wider Accessibility:

These updates also ensure that banking services are available to a broader audience. Customers who may not have access to traditional banking facilities can now perform essential transactions conveniently at CSPs across the country.

Financial inclusion is a critical goal for governments and banks worldwide. By expanding services to CSPs, SBI is playing a vital role in bringing banking services to remote and underserved areas. This empowers individuals and businesses in these regions to participate in the formal financial system.

Transitioning Towards a Digital Future:

The inclusion of these features in the SBI Kiosk Portal marks a significant step toward India’s digital banking future. As more customers embrace digital transactions, these enhancements align perfectly with the government’s Digital India initiative, which aims to make financial services more inclusive and accessible.

The Digital India initiative, launched by the Indian government, envisions a digitally empowered society and knowledge economy. SBI’s proactive approach to digital banking aligns seamlessly with this vision. By offering services like mini statements and OTP-based cash deposits, the bank is contributing to the broader goal of promoting digital literacy and financial inclusion.

Conclusion:

In conclusion, the continuous updation and upgradation of the SBI Kiosk Portal demonstrate the bank’s unwavering commitment to its customers. These developments boost convenience and security. They also bring banking services closer to those in need. As technology advances, SBI Kiosk Portal serves as a beacon, ensuring confident navigation in digital banking.

In this era of internet-driven financial services, SBI Kiosk Portal’s updates demonstrate the bank’s dedication to improving customer service. As we move towards a more digitalized banking ecosystem, SBI maintains its leadership by adapting to customers’ evolving needs. These updates prioritize security and convenience, enabling SBI Kiosk Portal to set new benchmarks in digital banking, keeping pace with technology.

Also read: SBI WhatsApp Banking: Revolutionizing Real-Time Banking Experience

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

It iis in reality a great and useful piece of information. I am happy that you just shared

this useful information with us. Please stay uss uup to date like this.

Thank you for sharing.

Look at my web-site – https://vavada.webgarden.com/

Thank you so much for your kind words! I’m thrilled to hear that you found the information useful. I’ll definitely keep sharing valuable updates. Your support is truly appreciated!

Thank you sir