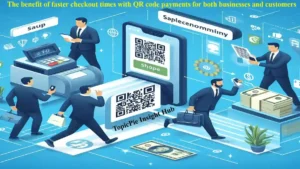

In today’s competitive landscape, small businesses are constantly seeking ways to improve customer experience and streamline operations. One major hurdle? The traditional payment process. Long checkout lines, limited payment options, and the need for physical cash or cards can frustrate customers and lead to lost sales. But there’s a game-changing solution: QR code payments.

QR code payments are revolutionizing the way small businesses handle transactions. These ubiquitous square barcodes, easily scanned with a smartphone camera, offer a fast, secure, and contactless payment solution that benefits both businesses and their customers. Gone are the days of fumbling with cash or cards – with a simple scan, a purchase is complete. This not only reduces wait times and improves customer satisfaction but also eliminates the need for expensive point-of-sale terminals.

As an added bonus, QR code payments are gaining global traction. The ASEAN Integrated QR Code Payment System, for example, paves the way for seamless cross-border transactions using QR codes.

Stay tuned as we delve deeper into the world of QR code payments for small businesses. We’ll explore the history and evolution of this technology, highlight the key benefits it offers, and provide a step-by-step guide on implementing QR codes for a smooth and efficient QR code payment system in your business.

How QR Codes Revolutionized Payments: A History of Efficiency:

QR codes have come a long way since their humble beginnings in Japan, where they were originally used for tracking parts in the automotive industry. Their potential for streamlining financial transactions was quickly recognized. As technology and consumer behavior evolved, QR codes seamlessly integrated into payment systems, offering a game-changer for businesses and customers alike.

This integration ushered in an era of unparalleled convenience and efficiency. Gone are the days of fumbling with cash or cards – a quick scan on a smartphone completes the transaction. This shift towards contactless payments not only simplified processes but also ushered in enhanced security features with advancements in encryption and authentication methods.

You may also like to read: Blockchain Revolution: Transforming Industries with Innovative Technology

The rise of QR code payments is further fueled by the increasing demand for convenient and secure solutions. As businesses embrace digital transformation, QR code payments have become essential in providing seamless transactions for customers. Today, small businesses worldwide leverage these systems to streamline operations and offer a frictionless payment experience.

The ASEAN Integrated QR Code Payment System exemplifies how countries are collaborating to promote seamless cross-border transactions using QR codes. This technology’s ability to adapt and evolve has made it a reliable solution for businesses looking to cater to modern consumer preferences in a fast-paced world.

Streamlining Payments: The Advantages of QR Codes for Small Businesses

QR codes have revolutionized payment systems for small businesses, offering a multitude of advantages that enhance both convenience and security.

Frictionless Transactions: Gone are the days of fumbling with cash or waiting for card swipes. Customers can now make instant payments with a simple scan using their smartphones. This contactless approach not only saves time but also promotes a hygienic experience, a significant factor in today’s health-conscious environment. QR code payments offer flexibility as well – transactions can be completed anywhere, anytime, eliminating the need for additional hardware like point-of-sale terminals.

Enhanced Security Features: Security remains paramount in the digital age. QR code payments prioritize this aspect with features like encryption technology and secure authentication protocols that safeguard sensitive information during transactions. This multi-layered approach minimizes the risk of fraud and data breaches, further protecting both businesses and their customers. Real-time transaction monitoring allows for the swift detection of suspicious activity, while multi-factor authentication methods like PIN verification or biometrics add an extra layer of security. By prioritizing these features and staying updated on cybersecurity advancements, businesses can maintain a robust defense against evolving threats.

Simplified Implementation: Small businesses can easily integrate QR code payment systems into their operations, streamlining the checkout process and reducing reliance on cash handling. The ASEAN Integrated QR Code Payment System exemplifies the ease of adoption, paving the way for seamless implementation of this technology into diverse business models.

In essence, QR code payments offer a win-win situation for small businesses. They provide a convenient, secure, and efficient payment solution for customers, while simultaneously simplifying operations and enhancing cash flow for businesses. This combination of benefits makes QR codes a game-changer for small businesses looking to thrive in the modern marketplace.

Transitioning to Digital: Implementing Contactless Payments for Your Small Business

QR code payment systems offer a simple and secure way for small businesses to streamline transactions and cater to the growing demand for contactless payments.

Benefits and Ease of Adoption:

Implementing QR code payments is a cost-effective solution accessible to businesses of all sizes. Unique codes can be generated through various mobile apps or by partnering with payment service providers. This eliminates the need for physical cash or cards, expediting transactions and enhancing the customer experience.

Embracing QR codes positions your business as tech-savvy and allows you to cater to a broader customer base, including those who prefer convenient contactless payments. This can be particularly beneficial in regions like Southeast Asia, where the ASEAN Integrated QR Code Payment System simplifies cross-border transactions and fosters economic growth.

Also Read: SBI WhatsApp Banking: Revolutionizing Real-Time Banking Experience

The Implementation Process:

Here’s how to get started with QR code payments:

- Generate Unique Codes: Utilize a reliable QR code generator to create unique codes for your products or services. These codes can be displayed at checkout points, printed on receipts, or even included in invoices for easy customer scanning.

- Choose a Payment Processor: Select a payment processor that integrates seamlessly with your existing point-of-sale system and supports QR code transactions. This ensures smooth processing and reconciliation of payments.

- Train Your Staff: Proper staff training on how to use QR codes effectively is crucial for a successful transition. This includes understanding how to generate codes, troubleshoot scanning issues, and answer customer queries about the process.

By implementing QR codes successfully, small businesses can:

- Boost Efficiency: Streamline checkout processes and reduce reliance on cash handling.

- Attract New Customers: Cater to tech-savvy customers who prefer contactless payments.

- Stay Competitive: Demonstrate innovation and adaptability in an evolving payment landscape.

- Expand Reach: In regions with integrated systems like ASEAN, reach a wider customer base across borders.

The Future of Payments:

QR code payments represent a significant shift towards a more digital and convenient payment experience. By embracing this technology, small businesses can position themselves for success in the dynamic market of today and tomorrow.

QR Codes: A Modern Payment Solution for Businesses of All Sizes

QR codes have transformed the way businesses accept payments, offering a surge in convenience and efficiency for both merchants and customers. From small shops to global corporations, this technology is gaining widespread acceptance due to its numerous advantages.

Benefits for Businesses and Customers:

- Effortless Transactions: Setting up QR code payments is simple, with user-friendly solutions available for businesses of all sizes. Customers appreciate the speed and ease of scanning a QR code to complete purchases, eliminating the need for physical cash or cards. This contactless approach is ideal for today’s fast-paced environment where hygiene is a priority.

- Enhanced Customer Satisfaction: QR codes streamline checkout processes, reducing transaction times and queues. This translates to a smoother customer experience, fostering loyalty and repeat business.

- Versatility Across Industries: Whether it’s in-store or online purchases, QR codes offer a convenient payment option for various businesses. The technology caters to modern payment preferences and can be integrated seamlessly with existing point-of-sale systems.

Also Read: Central Bank Digital Currency: The eRupee Revolution in India

Getting Started with QR Code Payments:

- Choose a Payment Provider: Select a reliable payment processor or mobile wallet provider that offers QR code solutions. Factors to consider include fees, features, and ease of integration with your existing systems.

- Register and Link Accounts: Register your business with the chosen provider and link your bank account to facilitate transaction settlements.

- Create Unique QR Codes: Generate unique QR codes for your products or services. Many providers offer customization options to match your brand identity.

- Display and Educate: Prominently display the QR codes at checkout counters, include them on invoices and receipts, and train your staff to assist customers efficiently with QR code payments.

A Growing Trend with Staying Power:

The increasing acceptance of QR codes by global businesses signifies a lasting impact on the payment landscape. As more companies recognize the benefits of this technology, we can expect further innovation in QR code applications and security measures. By embracing QR codes, businesses position themselves to cater to modern consumer preferences and enhance their overall customer experience.

Security Measures for Safe QR Code Payment Transactions:

While QR code payments offer convenience and speed, security remains a top priority for both businesses and consumers. Here’s how to navigate this landscape safely:

Potential Risks:

- Phishing Scams: Fraudsters can create fake QR codes that steal personal information. Always verify the source of a QR code before scanning, especially if it appears unsolicited or suspicious.

- Malware: Malicious software might be embedded in QR codes. Use a reputable QR code scanning app and keep your device’s software updated to combat this threat.

- Data Breaches: Sensitive information stored within the QR code itself can be vulnerable. Limit data embedded in the code to essential payment details and avoid including personal information.

Security Measures for Businesses:

- Encryption: Implement robust encryption protocols to safeguard customer data during transactions.

- Payment Gateways: Utilize secure and trusted payment gateways to prevent unauthorized access and fraudulent activities.

- Multi-Factor Authentication: Add an extra layer of security with multi-factor authentication, requiring users to verify their identity beyond just a password.

- Software Updates: Regularly update software and systems to patch security vulnerabilities.

- Employee Training: Educate staff on cybersecurity best practices to prevent social engineering attacks and internal breaches.

- Transaction Monitoring: Monitor transactions for irregularities or suspicious activities to identify and address potential security threats promptly.

By prioritizing these security measures, businesses can create a safe and trustworthy environment for QR code payments, fostering customer confidence in this innovative technology.

The Evolving Landscape of QR Code Payment Transactions: A Glimpse into the Future

QR code payments are rapidly transforming the way we conduct transactions. As we look ahead, several exciting trends are poised to shape the future of this innovative technology:

Global Expansion: QR codes are experiencing a surge in global adoption as a preferred method for contactless payments. This widespread acceptance offers unprecedented convenience and efficiency for consumers around the world.

Enhanced Security: Innovation in QR code technology is prioritizing advanced security features. Robust encryption protocols and multi-factor authentication methods are continuously being developed to ensure safe and secure transactions for both businesses and customers.

Industry Integration: The use of QR codes is expanding beyond traditional retail. Businesses in healthcare, transportation, and other sectors are recognizing the value of this versatile payment solution. This trend signifies the potential of QR codes as a universal payment option across various industries.

Digital Wallet Integration: As digital wallets gain traction, QR codes are becoming a vital tool for facilitating seamless payments across platforms. This synergy between QR codes and mobile payment solutions offers a streamlined experience for in-store and online transactions.

E-commerce Adoption: E-commerce websites are increasingly embracing QR codes to provide customers with a swift checkout process. This highlights the importance of adapting to the growing digitization of the payment landscape.

In conclusion, QR code payment solutions are undergoing continuous innovation and hold immense potential to revolutionize the future of financial transactions. By prioritizing security, expanding integration, and embracing digital trends, businesses can leverage QR code technology to enhance customer experiences, streamline operations, and remain competitive in the ever-evolving world of payments.