Managing your pension after retirement is crucial to ensuring financial security and comfort during your golden years. Yet, for many pensioners, the process of handling pensions can become cumbersome, particularly when it involves frequent trips to the bank for paperwork and other formalities. Thankfully, the State Bank of India (SBI) has introduced a solution to simplify this task for its pensioners—Pension Seva SBI.

In this blog, we will explore how the Pension Seva SBI portal can help pensioners easily manage their pensions online. From registering on the platform to accessing essential pension-related services, this guide will cover every aspect of using the PensionSeva SBI portal efficiently.

What is Pension Seva SBI?

The Pension Seva SBI is an online portal launched by the State Bank of India. It assists pensioners in managing their pensions without visiting the bank physically. As part of SBI’s digital banking initiative, it aims to provide seamless services to customers. This portal is specifically tailored to meet the needs of pensioners across India.

Also Read: The Vital Role of Life Certificate in Ensuring the Financial Security of Pensioners

The portal serves as a one-stop solution for all pension-related services, offering features such as the ability to check pension payments, download important documents like the Pension Payment Order (PPO), submit life certificates online, and update personal information. These tasks, which traditionally required visiting a bank branch, can now be completed from the comfort of your home.

The introduction of PensionSeva SBI is a game changer for retirees who may find it difficult to visit the bank frequently due to health, mobility, or geographic constraints. It not only brings convenience but also ensures that pensioners have secure, transparent access to their pension data.

Key Services Offered by Pension Seva SBI

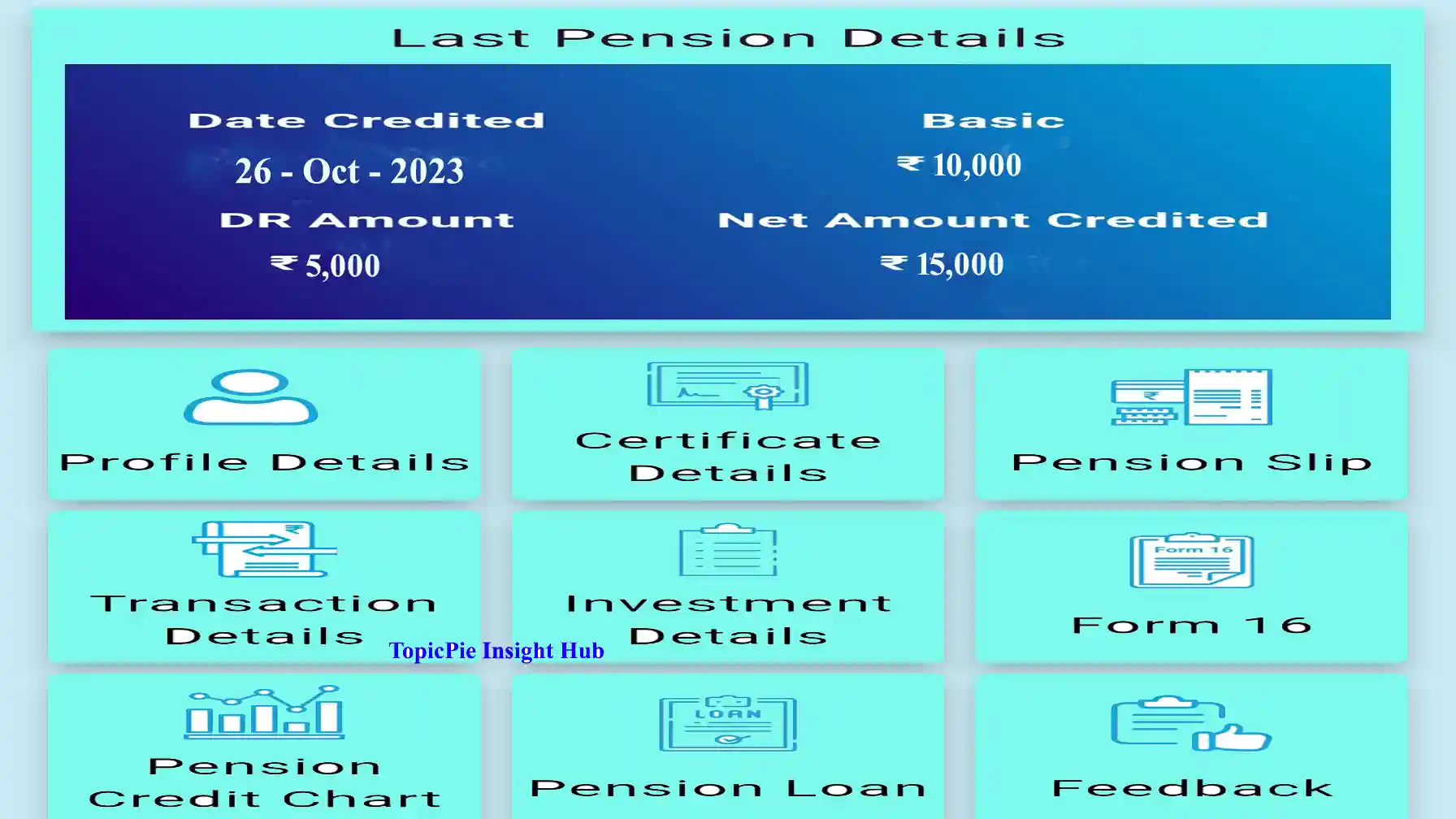

The Pension Seva SBI portal is designed to offer a range of services that help pensioners efficiently manage their pension-related affairs. Let’s take a closer look at some of the key features of this platform:

1. Access to Pension Details

Pensioners can easily check their pension payment history through the platform, including arrears and deductions, with just a few clicks. The ability to track payments and monitor your pension account regularly ensures that all transactions are accurate and up-to-date. This transparency also helps pensioners address any discrepancies in their account promptly.

By providing this service, Pension Seva SBI ensures that pensioners no longer need to wait for bank statements or visit branches to inquire about their pension status. This ease of access allows pensioners to have greater control over their finances.

2. Pension Payment Order (PPO) and Form 16 Downloads

Another crucial feature is the ability to download essential pension-related documents such as the Pension Payment Order (PPO) and Form 16. The PPO is a vital document that contains all the details about a pensioner’s retirement benefits, and Form 16 is required for income tax filing purposes.

Previously, pensioners had to visit the bank branch to collect these documents. With Pension Seva SBI, these documents are just a few clicks away, ensuring pensioners have immediate access to what they need, whenever they need it.

3. Submitting Life Certificates Online

One of the most significant challenges pensioners face is the annual submission of their life certificate to prove that they are alive and eligible to receive pension payments. Traditionally, this required visiting a branch in person, which can be particularly difficult for old pensioners or those with mobility issues.

However, with Pension Seva SBI, this process has been digitized. Pensioners can now submit their life certificates online through the portal, making the process far more convenient. This feature alone saves pensioners time and effort while ensuring they continue to receive their pension without interruption.

4. Account Updates and Personal Information

If pensioners need to update their personal information—whether it’s their address, phone number, or any other detail—they can easily do so via the Pension Seva SBI portal. Keeping personal information updated is essential to avoid missing out on important communication from the bank, especially regarding pension payments.

The ability to make these updates without visiting a branch simplifies the process, giving pensioners more flexibility and control over their account information.

5. Grievance Redressal

Should any issues arise—such as delayed payments or discrepancies in pension amounts—the Pension Seva SBI portal offers a dedicated grievance redressal system. Pensioners can log their complaints directly through the platform, ensuring that their issues are addressed swiftly by SBI’s customer service team.

This feature helps eliminate the frustration of lengthy complaint processes and gives pensioners confidence that their concerns will be resolved in a timely manner.

How to Register on the SBI Pension Seva Portal?

Getting started on the Pension Seva SBI portal is easy. The registration process is user-friendly and designed to ensure that pensioners can quickly begin managing their pensions online. Here is a step-by-step guide to help you register:

Step 1: Visit the Official Website

To begin the registration process, visit the official Pension Seva SBI website. The “New User Registration” option is clearly visible on the homepage.

Step 2: Enter Required Details

During the registration, you will be asked to provide essential details, including your Account Number, Pension Payment Order (PPO) number, date of birth, and registered mobile number. Ensure that the information you provide matches the records held by the bank, as any discrepancies may cause delays in the registration process.

Step 3: Create a Username and Password

Once your basic details are entered, you will need to create a username and password. It is important to choose a strong password that contains a mix of uppercase and lowercase letters, numbers, and special characters to ensure your account remains secure.

Step 4: Mobile Number Verification

An OTP (One-Time Password) will be sent to your registered mobile number to verify your identity. Enter the OTP in the required field to complete the verification process.

Step 5: Start Using the Platform

After successful registration, you can log in using your credentials and begin managing your pension with ease.

Login Process and Portal Navigation

Once you have registered on the PensionSeva SBI portal, logging in and navigating the platform is a seamless experience. Here’s how you can access your account:

- Step 1: Go to the official Pension Seva SBI website.

- Step 2: Click on the “Login” option and enter your username and password.

- Step 3: After logging in, you will be directed to your personalized dashboard.

The dashboard is designed to be intuitive and easy to navigate, allowing you to quickly find the information you need. Whether you are checking your pension details, downloading documents, or submitting grievances, the portal makes every task straightforward.

Benefits of Using Pension Seva SBI:

The Pension Seva SBI portal offers a host of benefits that make it an indispensable tool for pensioners. Here are some key advantages:

1. Convenience and Accessibility

Managing your pension has never been easier. With the Pension Seva SBI portal, pensioners can access their accounts 24/7 from the comfort of their homes. This level of convenience is invaluable, especially for those who have difficulty traveling to the bank or who live far away from branches.

2. Enhanced Data Security

SBI understands the importance of protecting pensioners’ personal and financial data. That’s why the Pension Seva SBI portal is equipped with advanced data encryption and security measures to prevent unauthorized access. Additionally, OTP-based login ensures that only authorized users can access the platform.

3. Transparency in Pension Disbursements

The portal provides complete transparency in pension disbursement. Pensioners can track their payments, view detailed statements, and monitor any deductions or arrears. This transparency minimizes the chances of discrepancies and ensures pensioners can trust that they are receiving the correct amount.

4. Quick Grievance Resolution

With a grievance redressal system built directly into the portal, pensioners can resolve issues such as missed payments or incorrect deductions in a timely manner. This feature provides peace of mind, knowing that help is just a few clicks away.

5. Easy Document Access

From downloading PPOs to retrieving Form 16 for tax purposes, the portal eliminates the need for pensioners to make physical trips to their bank. All necessary documents are available for download on demand.

Managing Life Certificates on Pension Seva SBI:

Submitting an annual life certificate is mandatory for pensioners to continue receiving their pension payments. The Pension Seva SBI portal makes this process incredibly easy by allowing pensioners to submit their certificates online. This digital submission process saves time, reduces the need for physical visits, and ensures that pensioners don’t miss deadlines for submission.

This feature is particularly useful for old pensioners, those with mobility issues, or pensioners living abroad. With online submission, they can maintain compliance with the bank’s requirements from anywhere.

Grievance Redressal and User Support:

SBI has taken great care to ensure that pensioners can resolve any issues with ease. Through the Pension Seva SBI portal, pensioners can lodge complaints regarding any pension-related matter. Whether it’s a problem with payments, document access, or account information, the grievance redressal system ensures that issues are addressed in a timely manner.

Pensioners also have access to customer support via phone, email, or even chat options. With dedicated customer service, pensioners can rest assured that their concerns will be handled by professionals who are there to assist.

Security Features on Pension Seva SBI

Security is a top priority for SBI, and the Pension Seva SBI portal is no exception. The portal uses OTP-based authentication to ensure that only authorized users can access pensioners’ accounts. Additionally, advanced data encryption technologies protect all sensitive information stored on the portal.

For pensioners, knowing that their financial and personal data is secure gives them the confidence to use the portal without fear of cyber threats. SBI’s commitment to safeguarding pensioners’ information makes Pension Seva SBI a trustworthy platform for managing pensions.

SBI Pension Seva Mobile App: Pension Management On-the-Go

For pensioners who prefer managing their accounts via mobile devices, the SBI Pension Seva Mobile App is a great option. The app is available on both Android and iOS platforms, offering the same functionality as the website version. Whether you need to check your pension status or submit a grievance while on the go, the mobile app makes it possible.

The mobile app mirrors the user-friendly design of the web portal, ensuring that pensioners can easily navigate and manage their accounts no matter where they are.

Frequently Asked Questions (FAQs):

1. What services are available on the Pension Seva SBI Portal?

The Pension Seva SBI portal provides services such as checking pension payment details, downloading PPO and Form 16, submitting life certificates, updating personal information, and lodging grievances.

2. How do I register for the Pension Seva Portal?

You can register by visiting the official Pension Seva SBI website, entering your PPO number, date of birth, and mobile number, and verifying your identity through OTP.

3. Can I update my personal details through Pension Seva SBI?

Yes, the portal allows you to update your personal information such as your address, contact number, and more directly online.

4. How secure is the Pension Seva SBI Portal?

The portal is highly secure, using OTP-based authentication and advanced encryption to protect pensioners’ data from unauthorized access.

5. What to do if I encounter login issues?

If you face any login issues, you can contact Pension Seva SBI customer support via phone or email, or use the troubleshooting guide available on the portal.

Conclusion:

The Pension Seva SBI portal is an excellent tool for simplifying pension management. From easy access to pension details to downloading essential documents and submitting life certificates, this portal has revolutionized the way pensioners interact with their pensions. With robust security features, transparent transactions, and timely grievance resolution, PensionSeva SBI is a must-have for any pensioner looking to manage their pension efficiently.

If you’re an SBI pensioner and haven’t registered yet, we encourage you to take advantage of the Pension Seva SBI portal today. It offers convenience, security, and peace of mind, ensuring that managing your pension is a smooth and effortless process.